The Making of the 2018 Indoor Climbing Industry Report

Do you know how many check-ins the average climbing facility has each year? Or which programs the most successful climbing gyms offer? Until 2018, we didn’t know, either.

“One of the traditional roles of a trade association is to help members understand benchmarks,” explains CWA President & CEO Bill Zimmermann. “With no publicly-available data, we weren’t able to answer a lot of the inbound questions we were getting.”

That’s a big part of the reason CWA embarked on a year-long process to collect and analyze data from across the indoor climbing industry in 2018. It was a big step—the climbing industry has existed (and grown) for decades, but until now, we haven’t had good baseline information.

Benchmark studies allow business operators in mature industries—hospitality and fitness, for example—to understand their positions in the market and make decisions accordingly. Studies like these give stakeholders valuable insights, help them understand how they’re performing compared to others, make them better prepared for vendor negotiations, and help identify ways to increase revenue.

“This type of market intelligence helps us tell our industry’s story, which is useful for the general public’s perception of indoor climbing,” says CWA Marketing & Communications Manager Laura Allured, who was instrumental in initiating the industry research. At the beginning of this process, Allured conducted interviews with more than 40 people who represented member gyms. When she analyzed and categorized their responses, it was clear that industry research was a top priority.

The Process

Past attempts at industry-wide research were unsuccessful, in part because the lack of third-party analysis meant data was difficult to gather. With that lesson in mind, CWA set out to find a research partner with experience in survey design, data security, data analysis, and reporting. After an exhaustive search, CWA partnered with marketing research firm Campbell Rinker.

The next step was to set out a scope, including a mission statement and goals. Allured reached out to contacts across the industry to understand what sort of information would be useful to them. CWA contacts identified operations, marketing, facility profiles, programming, products and membership, risk management, and finance as the topics they were most interested seeing industry-wide research on.

From there, CWA and Campbell Rinker collaborated to develop the survey questions. Then it was time to figure out who should answer those questions.

“One big step in the process was identifying the ‘universe’ of gyms,” Allured explains. “When you’re studying a sample of a population, you have to understand how big the population is.”

CWA put together a list of climbing gyms in the United States and Canada using online resources and their existing membership list. The criteria facilities and companies needed to meet to be eligible to take the survey was simple: Gyms needed to be commercial climbing facilities, and climbing needed to be the primary activity conducted there. (In other words, climbing walls on university campuses or in rec centers fell outside of the criteria, since those business models are very different than those of climbing-centric facilities.)

Once they’d identified that population, CWA developed a marketing campaign to promote participation. Respondents opted into the study and filled out a form in order to participate, which allowed the researchers to validate that all responses truly came from eligible facilities.

The Results

Over the course of six weeks, 123 facilities associated with 81 companies responded to the survey. (That sample size is about 23% of the total population of eligible American and Canadian climbing gyms.)

“Because climbing gyms exist in a competitive space, we had some work to do—we had to assure participants that there was a benefit to their participation,” Zimmermann says.

“One of the big questions business owners have when deciding whether or not to participate is around privacy concerns,” Allured agrees. That’s why Campbell Rinker was the custodian of the data from start to finish—it was collected via their online survey tool, and CWA staff and board never had access to the raw data.

Once the data was in, it was time to slice and dice, as Allured puts it, and look at the data from as many different angles as possible.

“Our goal was to create baseline performance benchmarks for gym operators, as well as offer some insights into what the most successful companies were doing,” Allured says.

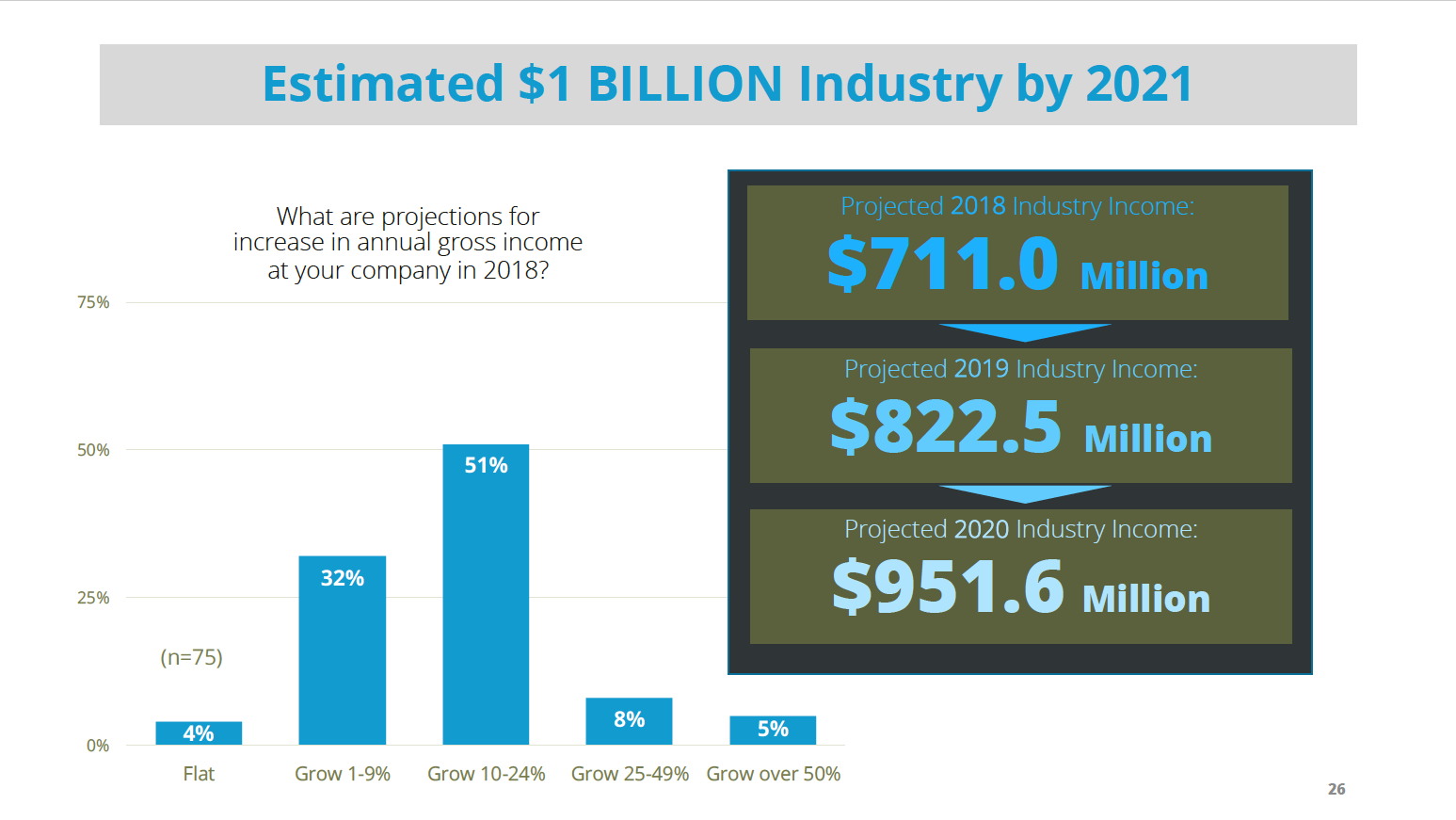

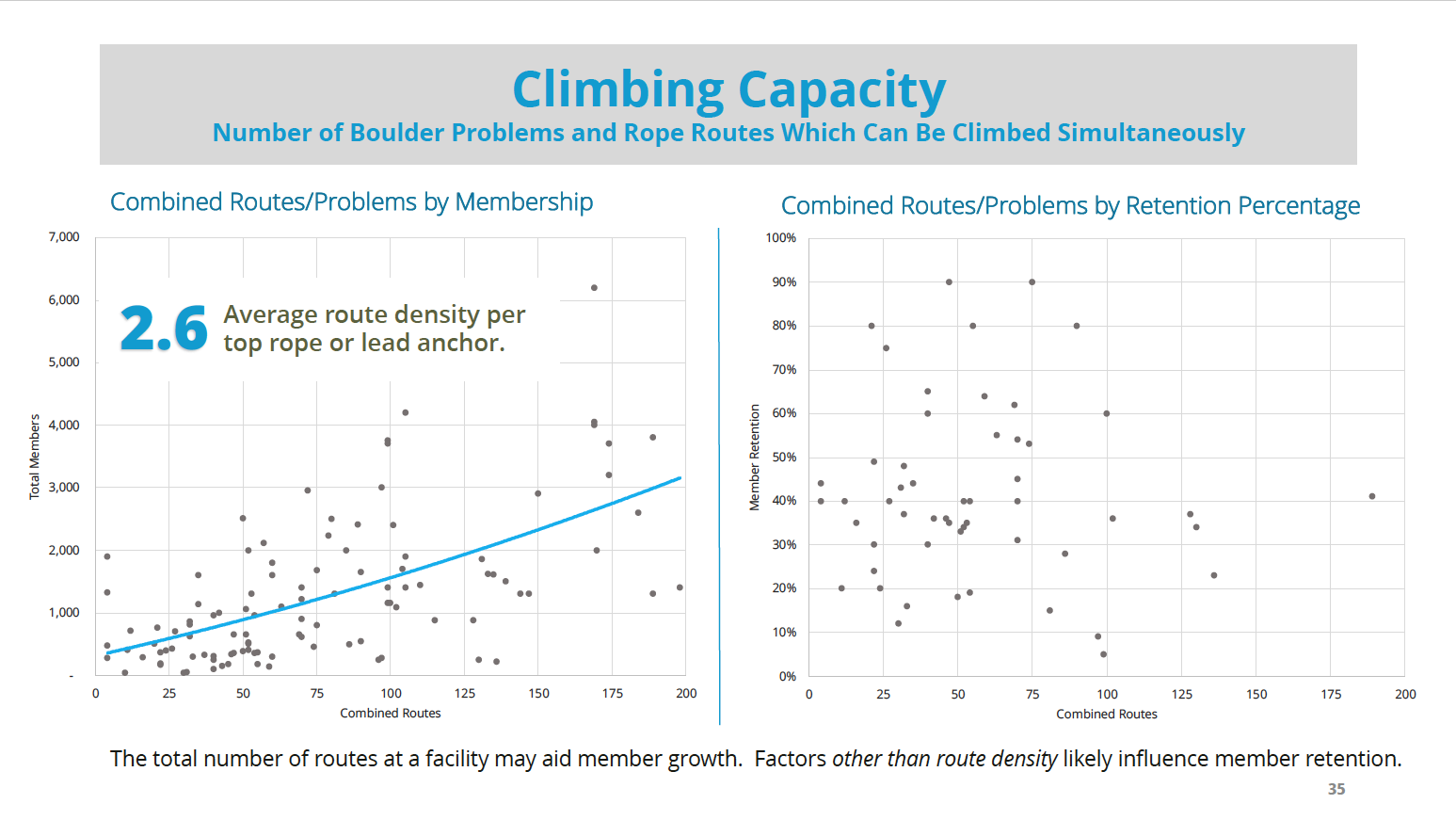

The results of the report did just that. They shed light on the number of visits climbers made to gyms and how long they stayed, what challenges facilities faced and how much potential they had for growth, and what activities, classes, and programs they offered. Most importantly, they provided the benchmarks the indoor climbing industry has been missing.

“For all practical purposes, we’re still a very young industry, and we’ve grown rapidly compared to other recreational climbing segments,” says Zimmermann of indoor climbing. “It’s only been in the last few years that brands have really started to take notice of that growth—and the influence we have on new climbers—and this kind of research really helps with that.”

“We had a sense that that was the case, and now we have the data to prove it,” he adds.

What’s Next

The information contained in the 2018 Indoor Climbing Industry Report is a great first step—after all, we need those benchmarks to understand and grow the overall market. But there’s still more work to be done.

“We’ve gotten some feedback that looking at industry-wide data says very little for an individual gym owner about how their facility is doing,” Allured says. CWA has heard that concern, and they’re working to improve the process so the data can be categorized into more useful segments.

Working with a research team at Clemson University, the CWA launched the 2019 Indoor Climbing Industry Survey on September 10. If you haven’t already received an invitation from Dr. Bob Brookover, sign up now – participating companies receive a free copy of the $650 summary report! The deadline to complete this year's survey is October 3.

About The Author

Emma Walker is a freelance writer, editor, and an account manager with Golden, Colorado-based Bonfire Collective. Emma earned her M.S. in Outdoor and Environmental Education from Alaska Pacific University and has worked as an educator and guide at gyms, crags, and peaks around the American West.

Emma Walker is a freelance writer, editor, and an account manager with Golden, Colorado-based Bonfire Collective. Emma earned her M.S. in Outdoor and Environmental Education from Alaska Pacific University and has worked as an educator and guide at gyms, crags, and peaks around the American West.