Steps in Preparing for a Crisis

Preparing for a crisis in an indoor climbing gym is not limited to risk management for climbing-related incidents or injuries. A crisis can stem from both internal and external risks, many of which may seem beyond your control. This article discusses several of these risks and steps gym operators can take to prepare for crisis-related scenarios.

Individual Topics:

- Climbing Risk Management

- Slip & Fall claims and facility management

- Abuse Prevention

- Property Damage and Weather-Related Disasters

- Cyber Crime

- Responding to a Crisis

Operational Risk Management

As a gym operator, you can use CWA’s Industry Practices as a first line of defense for risk management. Regularly review new policies and technologies to incorporate into your risk management program. Risk management is not a one-size-fits-all, and different technologies and policies that come out affect the future of your programs that are already in place. Don’t just “set it and let it”.

Monument Clients: Email CWA for Your Free IP Copy

Consider your floor staff as front-line risk managers for the enforcement of facility rules and gym operating policies, and ensure that, as the policies change, these front-line workers know about them.

Routesetting Risk Management

There are special considerations for routesetting risk management, both for the routesetters themselves and for the public. As far as the public is concerned, ensure starting holds are behind auto belay gates if you have auto belays in your facility. This ensures that an individual has a harder time being on autopilot and missing the opportunity to tie into the system.

For bouldering, setting the crux of the problems below the top out can manage the risk of injury to the climber. Consider the utilization of down-climb holds, both for the climber’s experience and so that climbers below are at less risk of being dropped or fallen on.

In general, routesetting areas should be cordoned off to prevent access by patrons if routesetting during open hours. Appropriate warning signage should also be utilized to further identify areas of the gym that are being set. This is a great strategy for both informing the public about when different areas of the gym will be reset (so climbers know when their projects will go away) and for keeping you as risk-averse as possible when setting during open hours.

CWA Insurance Program Members can enjoy discounted Certification Course rates, and insurance credits for staff certifications may be available.

Slip & Fall Claims & Facility Management

Cleanliness of the facility and facility maintenance is an important general item for all operators, not just to prevent slip and fall claim scenarios.

DID YOU KNOW? The overall physical appearance and cleanliness of the facility can be brought up in a claim scenario.

Facility-owned equipment, such as lifts or ladders, should be properly stored when not in use. Additionally, external maintenance, such as damaged sidewalks, should be reviewed regularly. Always check your lease agreement to determine your areas of responsibility, including the maintenance of common areas.

Abuse Prevention

A defined abuse prevention plan as part of your employee/operations manual that includes mandatory, ongoing staff training should be in place. Annual background checks should be run on all employees. MSG Clients and Members of the CWA Insurance Program have access to a discounted option for the national criminal and sexual offender background check.

Monument Clients can learn more about background checks here

Your Abuse Prevention Plan should also consider Peer to Peer Abuse scenarios. For example, two camp participants in the restroom at the same time. There are many third party training resources for indoor climbing gyms to explore including SafeSport, Praesidium, etc.

Property Damage & Weather-Related Disasters

As we enter the summer months it is important to pay attention to hurricane and wildfire season, but do not discount winter weather exposures and plan for those accordingly.

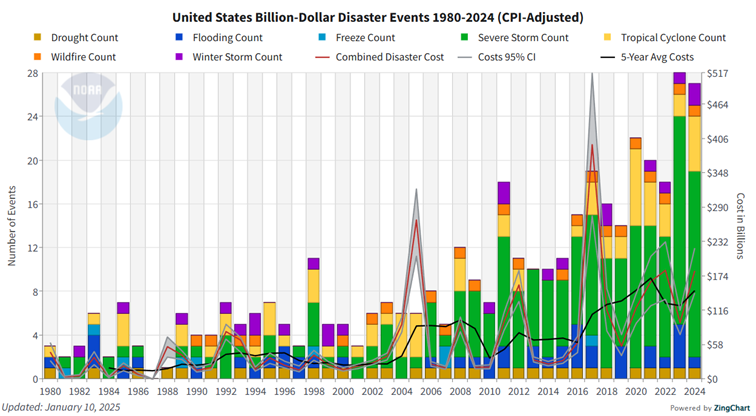

Weather related disaster events continue to increase in scope and size of financial impact across the U.S and the world.

Gyms should revise their emergency procedures based on potential weather-related scenarios in their area, including steps for facility preparations and what gym staff should prepare for at home. Depending on where your facility is located, you will want to pay attention to the regional risks. Folks in the Colorado foothills may be more interested in wildfire-related risk management than folks in New Orleans would be interested in flood risk management. If you are in a particular weather zone, carriers may have limitations on when you can bind or cancel coverage, such as during hurricane season.

Discuss property-related coverage with your agent or broker, as coverage limitations for elements such as flood, wildfire, or wind/hail deductibles may apply.

Consider flood prevention practices, including the removal of easily damaged property (such as electronic devices) and storing them in a secure location. Gyms should also consider additional flood prevention products.

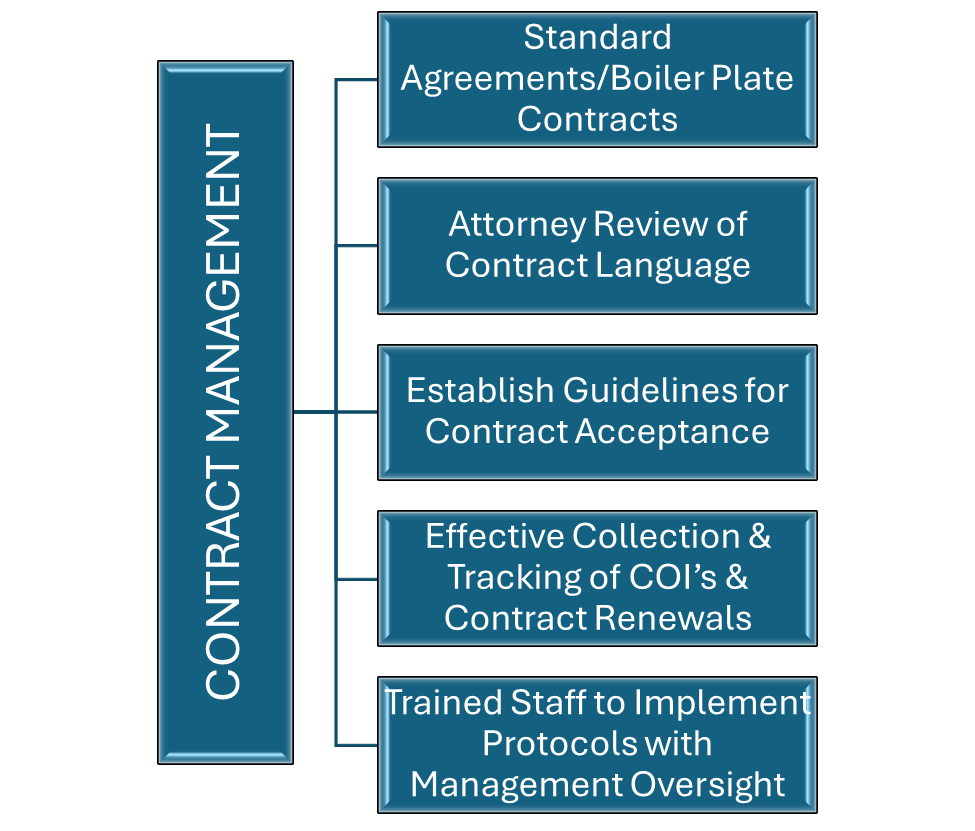

Ensure third-party maintenance contracts are in place for facility maintenance and preparation, including certificates of insurance to manage External Risks.

The following roadmap can be used for this process:

Property Management Contracts to prepare for External Risks include but are not limited to:

- Fire suppression

- Security monitoring

- Snow & ice removal for rooftops, parking lots, and walkways

- Road & building barriers to prevent vehicle impacts

- Roof maintenance, inspections, and repairs – know what your lease dictates and discuss coverage scenarios with your agent or broker

NOTE: Be prepared to follow all instructions from local or federal authorities and have a communication plan in place to alert staff and customers in the event of a weather-related disaster.

Cyber Crime

Cyber-related exposure continue to evolve with the increased adoption of AI systems. Phishing scams have grown more sophisticated and can result in large cyber related losses including data theft and wire-fraud.

- Develop strict policies on computer usage in the climbing gym by facility staff as part of your cyber security program. This includes restricting access to personal email or social media on work computers.

- Prior to clicking on emails requesting payment or emails containing hyperlinks to redirect you to another webpage, confirm the sender’s information is accurate. When in doubt reach out to the sending party directly.

- Gyms can choose to emulate larger firms like Apple and Amazon and ban the use of AI systems like ChatGPT.

- Ensure up-to-date anti-virus and anti-malware software installed on all work-related systems. Consult with a cyber security expert on best practices for your facility.

- Discuss Cyber Crime and Privacy Insurance Policies with your insurance broker. Coverage can vary dramatically on cyber specific policies including First-Party vs. Third-Party Liability Coverages, and policies may include elements of Postbreach Response Coverage and support resources made available as part of coverage.

Responding to a Crisis

Gyms should develop a written emergency response plan that all staff are trained in. Designate specific managers that will respond to inquiries from members, participants, members of the media, and/or government authorities such as EMS, police, etc.

Develop a standard response that all staff adhere to. Do not admit or assign fault and avoid “no comment” situations. Discuss appropriate lines of communication with your staff.

In the event of a weather-related disaster open lines of communication with staff are important, but in the event of a climbing related injury speculation, social media discussions, or group text conversations can confuse and hinder the claims process.

Document events thoroughly and preserve evidence for any incident or disaster, and alert/cooperate with your insurer and legal counsel to not jeopardize coverage in a claim scenario.

It is important to work with an experienced agent that understands the unique complexities of managing risks in climbing gyms, understands sport specific coverage and has extensive claims handling experience.

With climbers and former facility operators on staff we are best positioned to help climbing gyms navigate the complexities of the insurance markets, so you can run your business with confidence.

Please reach out to Monument Sports or the CWA directly for additional information, and we encourage you to complete the poll associated with this article if you are interested in more in depth articles or webinars on the various topics referenced in this article.

About Monument Sports Group

Mark Grossman is the Founder and President of The Monument Sports Group, which has been servicing the insurance and risk management needs of professional and amateur sports teams, leagues, facility owners, and players since 2000. In 2013, Monument Sports became the endorsed insurance provider for the CWA, and MSG is very proud of the CWA program. Mark was a five-sport letter winner in high school and played soccer when not hurt at The University of North Carolina. Mark is now able to start climbing despite being really old as he has successfully recovered from knee and hip replacement surgeries.

Mark Grossman is the Founder and President of The Monument Sports Group, which has been servicing the insurance and risk management needs of professional and amateur sports teams, leagues, facility owners, and players since 2000. In 2013, Monument Sports became the endorsed insurance provider for the CWA, and MSG is very proud of the CWA program. Mark was a five-sport letter winner in high school and played soccer when not hurt at The University of North Carolina. Mark is now able to start climbing despite being really old as he has successfully recovered from knee and hip replacement surgeries.

William Jorgensen, AAI is the CWA Program Manager for Monument Sports. Will was first introduced to climbing on his journey to earn Eagle Scout and hasn’t looked back. He was an Academic All-Conference Soccer Player at Ferrum College, and spent his weekend climbing in the backwoods of Virginia & North Carolina. Will completed his MBA at Ohio University, where he is also pursuing a Master’s Degree in Business Analytics. Will works directly with climbing gyms to help them secure insurance coverage.